Author

Gary Boakes

Director and Mortgage advisor

Gary has been a Mortgage Planning Consultant since 2010 and co-founded Verve Financial with his wife Michelle. Gary has extensive experience working with First time buyers, homemovers, remortgages and has specialised in new ...

If you’re looking to buy a new home, you’ve probably noticed that house prices have grown rapidly in recent months. According to data from the Office for National Statistics (ONS), house prices increased by 10.2% in the year to October 2021.

As you may remember, in 2020, the government’s implementation of the Stamp Duty holiday kickstarted the struggling housing market. Furthermore, the conditions of the first lockdown also encouraged people to consider moving home.

However, now that the holiday is over and our national lockdowns seem to be behind us, you might be wondering why this rapid rate of growth has continued. If you are, read on to find out why this may be.

The rise in house prices has significantly outstripped the growth of wages

The strong rate of growth in the UK housing market may come as something of a surprise to many people, as it far outstrips growth in wages. According to data from Statista, in the month of October 2021, wages only increased by 4.2%, less than half the increase in house prices.

While this may seem strange, this is because buying power only plays a small, though obviously not negligible, part in the movements of the housing market. Some of the main factors that influence it include:

- Consumer confidence

- Interest rates

- Supply and demand

This combination of factors means that there are a lot of moving parts in the housing market, which can sometimes make it difficult to accurately predict how it will change. That being said, if you’re well-informed then you can still make an educated guess.

Consumer confidence is high, with almost half of Brits believing the market will continue to rise

As you might imagine, consumer confidence plays a significant part in determining whether house prices rise or fall. When people feel confident that the market is healthy, they feel more willing to buy and this usually leads to continued growth.

This often leads to a self-fulfilling prophecy, although the cycle can be easily disrupted by a short-term fall in prices, which can lead to a confidence crisis.

For example, with the recent spike in Covid-19 cases due to the Omicron variant, some experts feared that the prospect of another lockdown could affect the housing market. Thankfully, that doesn’t seem to be the case.

According to market data published by Property Reporter, almost half of Brits believe that the housing market will continue to rise in the near future. This just goes to show how strong consumer confidence currently is.

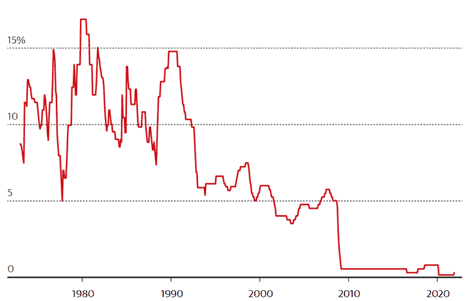

Low interest rates enable buyers to borrow significantly more

In 2020, the Bank of England (BoE) slashed its base rate to a historic low of only 0.1% in order to support the UK economy. While this allowed many businesses to borrow more cheaply, it also had an impact on the housing market.

As you might imagine, low interest rates mean that buyers can often afford to take out a larger loan, which leads to increased demand and can cause house prices to rise. Conversely, higher rates make borrowing more expensive, which can lead to a reduction in demand and house prices falling.

Source: The Guardian

In December, the BoE raised interest rates to 0.25% due to the impact of rising inflation on the UK economy. While, in theory, this would have a depressing effect on house prices, the rise is only a small one and so may only have a limited impact on the market.

As a whole, interest rates are still very low by historical standards, and this is helping to encourage the ongoing growth of house prices.

Global supply disruptions have reduced the number of UK homes being built

The final factor that influences property values is the ratio of supply and demand for homes. This is one of the most important factors and can have a large impact on the property market.

As we mentioned in our previous article about whether house prices would fall in 2021, in recent months the number of homes being built has fallen well below its pre-pandemic level. This has caused a lack of supply, which, in turn, raised the value of available properties.

One of the main issues currently faced by the construction industry is the difficulty in obtaining materials. As you may know, the pandemic has caused issues with global supply chains, making the price of many goods more expensive.

According to a survey published in the Guardian, 78% of housebuilders said that the supply and cost of building materials posed a huge problem for the industry.

This reduction in the number of properties being built, coupled with the strong demand for homes, is one of the main reasons that house prices are continuing to rise across the country.

Working with a professional can give you greater peace of mind when moving home

If you’re looking to move home in the near future and are concerned about rising property values making it difficult to afford a mortgage, speaking to a professional could help.

When you work with a mortgage consultant, they can help you to boost your chances of securing a loan. Since they have greater knowledge of the underwriting process, this can help them to find you a lender who is more likely to approve your application.

This can help to give you greater peace of mind to know that you’re maximising your chances of securing a mortgage.

Get in touch

If you’re considering moving home and want to gain more peace of mind by working with a professional, we can help. Email us at office@verve-financial.com or call 0330 320 5048.

Please note:

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

This item was correct at the time of writing and the information contained may no longer be up to date.