Author

Michelle Boakes

Chartered Financial Planner

Michelle started working in financial services in 2008, before becoming a Mortgage Advisor in 2011 and qualifying as a Financial Adviser in 2018. Michelle’s role is to meet with clients to discuss their goals and ...

Taking out life insurance is a great way of providing your loved ones with a financial safety-net in the event of your death.

But if you’re one of the many families whose wallets are squeezed, you might view life insurance as an optional expense rather than an essential one.

Without life insurance, there’s a risk that your loved ones will suffer financial hardship, be unable to pay the bills, and have to resort to selling their home.

Fortunately, there are some steps you can take to reduce the cost of life insurance. Read on to discover our five top tips.

1. Quit smoking

When an insurer calculates the premium to charge you, they’ll use modelling tools to determine the risk of you dying. They’ll look at various factors, including your age, body mass index, alcohol intake, and whether you smoke.

Smoking can significantly increase your life insurance premiums. According to MoneySuperMarket data collected over the 12 months to April 2020, the average non-smoker will pay £7.99 per month for standard decreasing term life insurance, whereas the average smoker will pay £14.19. By quitting smoking, you could save around £6.20 a month, or £74.40 a year.

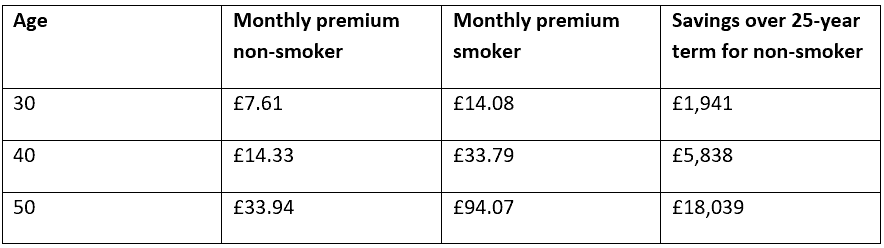

The potential savings tend to be bigger the older you are. Data from Royal London shows a 50-year-old taking out £150,000 worth of level life cover could reduce their premiums by as much as £60 per month.

Source: Royal London

Even if you only have the occasional cigarette, you’ll still count as a smoker for life insurance purposes. To benefit from reduced premiums, you need to prove that you’ve cut out all nicotine products and replacements for at least 12 months.

Quitting the habit will also be good for your health. According to the NHS, smoking increases your risk of developing more than 50 serious health conditions. Some may be fatal and others can cause irreversible long-term damage to your health.

2. Consider decreasing term insurance

There are two main forms of life insurance: whole of life insurance and term life insurance.

Whole of life insurance covers you for your entire life, so as long as you keep paying premiums, your family will receive a payout regardless of long you live. In contrast, term life cover pays out if you die during the specified policy term.

Whole of life insurance is usually more expensive than term life insurance because the insurer knows they’ll have to pay out at some point.

The right policy for you will depend on your individual circumstances and what you want to insure against. Whole of life insurance can be a useful way of covering an Inheritance Tax bill or funeral costs.

If your main goal is to ensure your mortgage is paid off, then you might want to consider decreasing term life insurance. The payout your loved ones would receive reduces over time in line with your outstanding mortgage balance.

Decreasing term life insurance tends to be cheaper than level term life insurance, where the payout stays the same throughout the policy. However, it isn’t usually suitable for interest-only mortgages and probably won’t help your loved ones pay for other expenses.

A financial adviser can help you decide which type of life cover is right for you.

3. Pay annually

Some lenders offer a discount to people who pay for their life insurance annually as opposed to monthly.

For example, Legal & General offers a 4% discount which, for a non-smoker taking £100,000 of life cover over 20 years, could result in a £3.73 saving over one year and a £74.60 saving over the policy term.

4. Buy life cover when you’re young

In general, the younger you are, the lower your life insurance premiums will be. This is because there is less risk of you dying during the policy term.

Research by MoneySuperMarket suggests someone who buys £150,000 of life insurance at age 20 would pay around £5 per month. By the time you reach age 35 to 45, the average premium rises to £18.28 a month.

Even if you’re paying for longer, you could pay less money overall by taking out cover when you’re young. Using the above example, if an 18-year-old pays £5 a month until he’s 68, the total cost would be £3,000. But if a 30-year-old pays £11.79 a month until he’s 68, the total cost rises to £5,376.

5. Speak to a financial adviser

A financial adviser will search the market to find the right life insurance for you. They will:

- Make sure you have the right type of life insurance for your individual needs

- Check if you have death-in-service cover from your employer

- Ensure you have the right amount of cover

- Help you decide whether to take out other forms of protection, including Critical Illness Cover and Income Protection

- Check whether you could get a discount on combined cover

- Advise on whether a joint or single life insurance policy would be more suitable.

By getting advice from a financial adviser, you can rest assured that you and your family’s needs are taken care of.

Get in touch

If you’d like to speak to an expert about life insurance, please get in touch. Email us at office@verve-financial.com or call 0330 320 5048.