November 17, 2020

How to look after your health and financial wellbeing this winter

Home / How to look after y...

As the days get colder and shorter, it’s easy for our health to be affected.

Most people are aware of the so-called ‘winter blues’ – when our mood and energy levels take a tumble.

You might be less familiar with the link between health and finances. A 2017 report by the charity Money and Mental Health found a quarter of people with a mental health problem are in problem debt, and half of people in financial difficulties have a mental health problem.

If you want to boost your health and finances this winter, read on to discover our five top tips.

1. Quit smoking

Smoking is one of the worst things you can do for your health and financial wellbeing.

According to the NHS, smoking increases your risk of developing more than 50 serious health conditions, including several types of cancer, heart disease, stroke, and pneumonia.

Smoking can be a huge drain on your finances. Figures from Nicorette show the average pack of 20 cigarettes costs £10.76. Someone who smokes 10 cigarettes a day could therefore save around £164 a month by quitting the habit.

Stopping smoking could also save you money on protection premiums. When you take out life insurance, Critical Illness Cover or Income Protection, your insurer will typically ask whether you’ve smoked or used nicotine replacement products in the last 12 months.

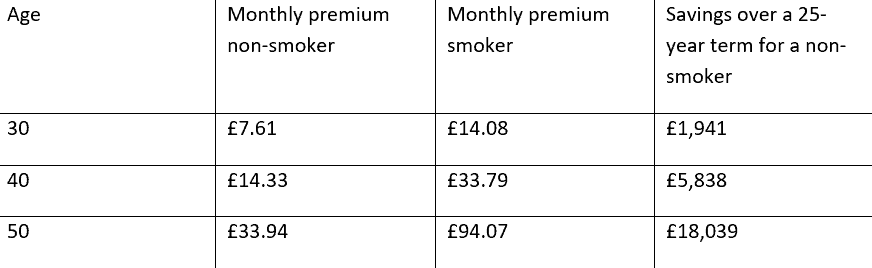

Data from Royal London shows a 40-year-old taking out £150,000 worth of level life cover over a 25-year term could see their monthly premiums more than double if they smoked. For a 50-year-old smoker, their monthly premiums could almost triple.

Source: Royal London

Quitting smoking isn’t easy but your health – and wallet – will thank you.

2. Get a financial health check

When you reach age 40, you might be offered an NHS Health Check, which is designed to spot early signs of diseases like diabetes and heart disease.

You don’t have to wait until you’re 40 to get a financial health check. Taking a thorough look at the state of your finances is a useful exercise at any age. It can:

- Give you a clearer understanding of your financial situation

- Help you create a budget

- Check whether your savings and investments are structured efficiently

- Help you understand how much money you might have at retirement.

A financial health check is a great way of ensuring you’re not overspending and that your life and financial goals are on track. It can alleviate any money worries you might have, thereby helping to improve your mental wellbeing.

3. Exercise

When winter arrives, it’s tempting to hibernate. However, exercising will increase your chances of banishing those winter blues, and it could even help you save money.

Some life insurers will reduce the premiums you pay if you regularly exercise. They may even provide discounts off a range of lifestyle and wellbeing activities. For example, Vitality enables you to earn points by recording your exercise via an activity tracker. The more points you earn, the bigger the discounts and rewards you could receive.

According to the Department of Health and Social Care, physical activity improves sleep and helps you manage stress. If you’re self-employed, this could help to boost your productivity and benefit your business.

4. Protect yourself from financial shocks

Protecting yourself and your loved ones from unexpected financial shocks is an important way of looking after your health and financial wellbeing.

You might think ill-health won’t happen to you, however, a 2018 report by Royal London shows around a million workers are off sick for more than a month every year. This could have a severe impact on your finances, as 52% of workers surveyed said they would worry about their income if they became too ill to work for longer than a month.

Income Protection is a type of insurance that provides a monthly payout if you’re too ill or injured to work. It can provide reassurance that you’ll still be able to pay your bills if the worst happens. Some insurers offer rehabilitation services that could enable you to return to work, and good health, sooner.

Other forms of protection to consider are life insurance, which pays a lump sum to your loved ones if you die, and Critical Illness Cover, which pays you a lump sum if you’re diagnosed with a very serious illness.

The peace of mind you’ll have from knowing you’re protected against life’s ‘what ifs?’ shouldn’t be underestimated.

5. Work with a financial adviser

Working with a financial adviser can help to improve your finances and your mental health.

Research by the International Longevity Centre in 2017, and updated in 2019, suggests people who take financial advice could boost their wealth by £47,000 over the course of a decade compared with those who do not.

This uplift in wealth comprises an extra £31,000 of pension wealth and more than £16,000 extra in non-pension financial wealth.

Meanwhile, Royal London has found that financial advice helps to boost your emotional wellbeing. Its 2020 survey of more than 4,000 people found 63% of people who took financial advice felt financially secure and stable, versus 48% of individuals who did not.

People who worked with a financial planner also felt more prepared to cope with life’s shocks, more confident about the future, and less anxious about their household finances.

Get in touch

To find out how we can help you look after your health and financial wellbeing, email office@verve-financial.com or give us a call on 0330 320 5048.