May 19, 2021

Cutting through the jargon: bull and bear markets explained

Home / Cutting through the...

One of the biggest impacts of the coronavirus pandemic in 2020 was the significant economic downturn in the first quarter, as markets struggled with the shock of the initial lockdown.

If you’ve been paying attention to headlines in recent months, you may have seen the terms “bull market” and “bear market” being used when talking about finances. It might even make you wonder why you’d need a zoology degree to understand the economy.

The language used in finance can sometimes seem difficult to understand, but it’s often much simpler than you may think. Read on to find out what this jargon really means and how it impacts you.

Bear and bull markets are used to describe the general wellbeing of the economy

To put it simply, these two terms reflect the performance of investments in a given period.

- A bull market is one that is on the rise and is usually the sign of a sound economy. The name comes from the way that the animal attacks opponents – it thrusts its horns upwards.

- A bear market is the opposite of this, where prices fall and can be a sign that the economy is faltering. Again, this name comes from the animal’s behaviour as when a bear fights it swipes downwards.

Typically, a market is considered bullish when the price of an investment rises by 20% over an extended period, which is usually defined as two months or more.

A bull market is one which is generally on the rise and the economy is doing well. There is also usually strong investor confidence, which is buoyed by the rising prices, and so often reflects a strong economy.

When prices decline, this is considered a bear market and is often a sign of an ailing economy. Due to the falling value of stocks, there is typically low investor confidence.

Bear market rallies are temporary bounces in a general downwards trend

If you’re an investor, whenever the market falls, you’ll usually hope that there will be a rebound. But one thing to be wary of is the possibility of a bear market rally.

Essentially, this is a short-term recovery where assets quickly increase in value over a period of days and weeks. While you might hope that this is the beginning of a recovery, it isn’t always the case.

Remember that for a market to be considered bullish, it needs to have been rising for at least two months. While short-term spikes might give you some hope for recovery, it’s important to be patient.

The obvious risk is that if you are overly optimistic then you may rush to invest at the first sign of recovery. However, if an asset’s increase in price is only temporary, and the market is still bearish, you could lose money.

Bull markets are much more common than bear markets

If you want to make sure that you avoid mistakes like this, so they don’t impact your progress towards your financial goals, it’s important to learn from the past.

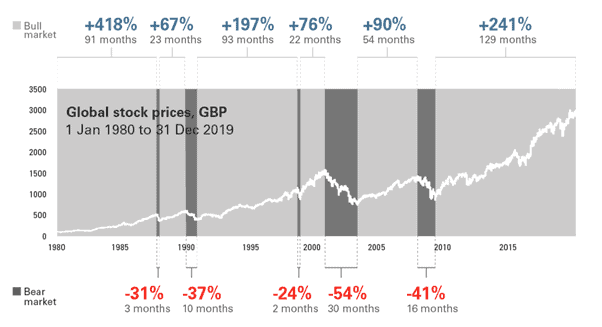

The graph below shows the performance of global stock prices since 1980 and can be useful for understanding more about bull and bear markets.

Source: Vanguard

One of the first things you may notice is that, on the whole, bull markets tend to be significantly longer than bear markets. This means that if you want to grow your wealth, it’s important to invest for the long term.

There are also clear examples of the bear market rally, which we just talked about previously. As you can see, while there is often a temporary increase in prices during a bear market, it usually doesn’t last long.

It’s important to seek financial advice when investing

When you invest, it’s easy to see a bear market and panic. The thought of losing money can sometimes prompt people to sell off their assets in the hope of minimising the loss, even when this is harmful for their long-term prospects.

The overriding headline from the graph above is that, over the long term, the value of these markets has typically risen.

If you want to ensure that you grow your wealth as effectively as possible when investing, you may benefit from seeking professional advice. This can help you to avoid mistakes such as panic selling so that they don’t affect your progress towards your goals.

Furthermore, working with an adviser can help you to clarify any issues that you don’t understand, allowing you to make informed decisions.

Finally, they can help you to diversify your portfolio, which helps to reduce the impact of market downturns on your wealth.

As we mentioned in a previous article on the dangers of DIY investing, one of the benefits of working with a financial adviser is that they can spread out your investments in a variety of asset classes and sectors to reduce the risk. This makes your portfolio more resilient to shocks.

Get in touch

If you think you would benefit from working with a financial adviser, get in touch. Email us at office@verve-financial.com or call 0330 320 5048.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.